Accounting Which Table to Use for Net Present Value

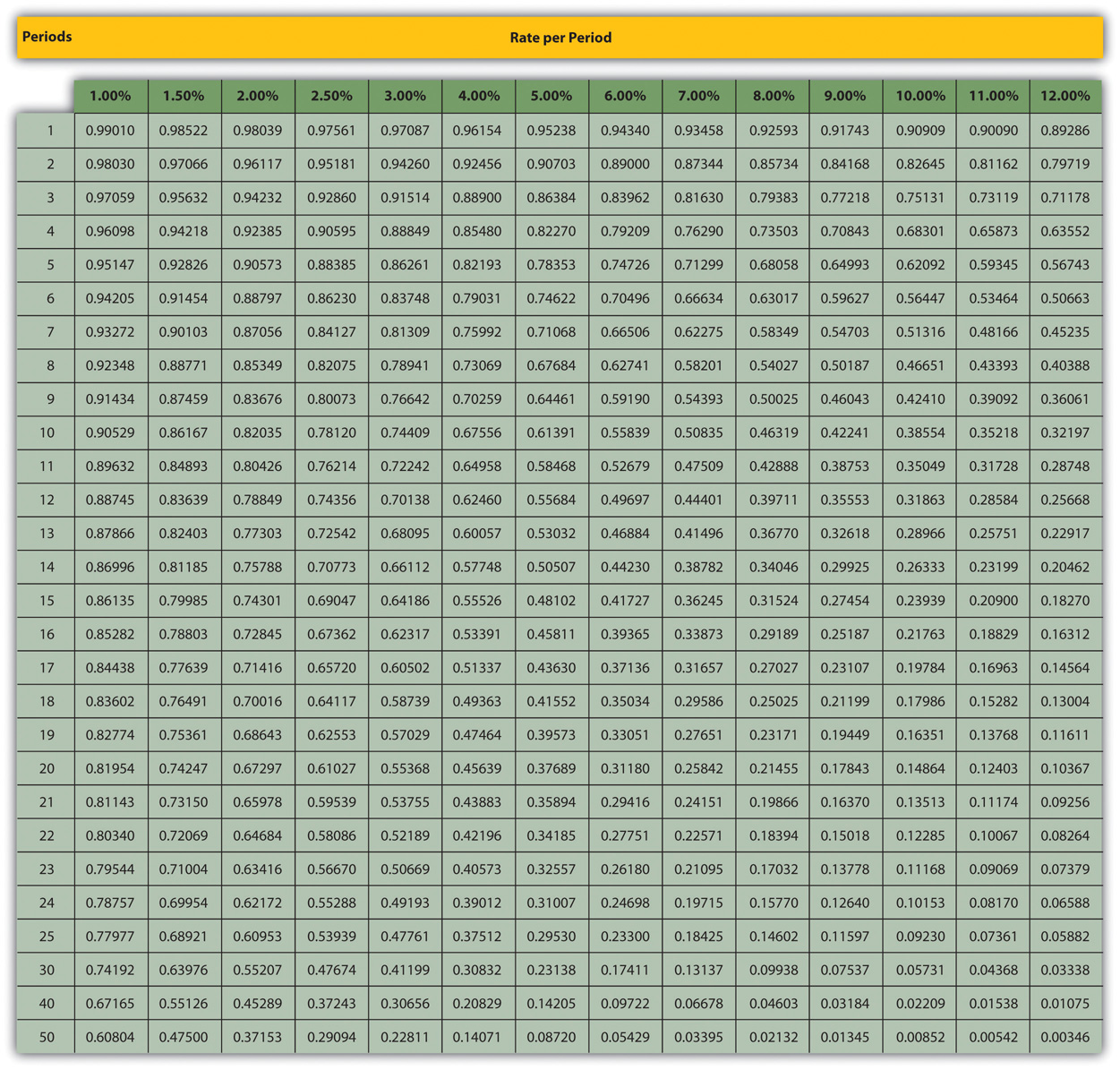

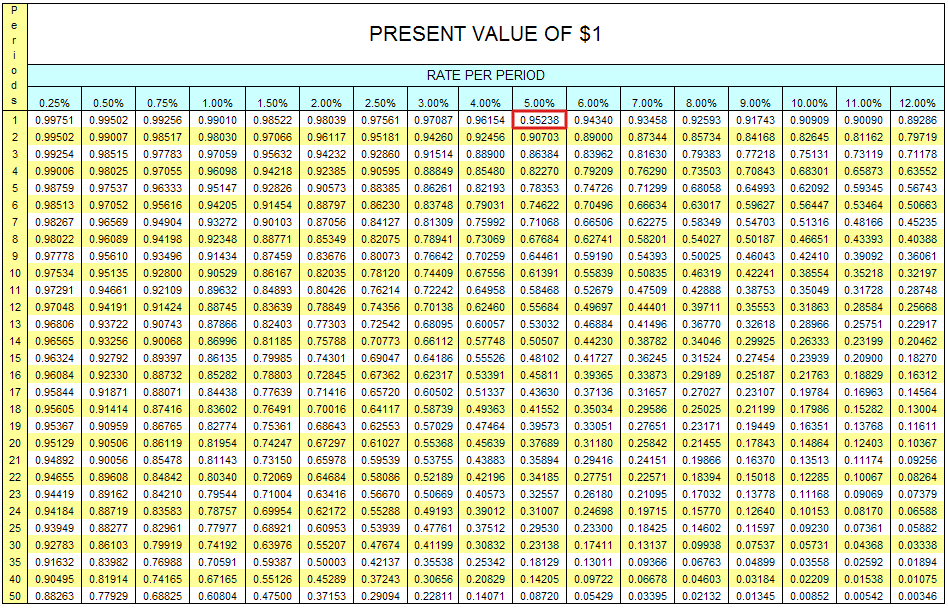

PRESENT VALUE TABLE. The first column n refers to the number of recurring identical payments or periods in an annuity.

Payback And Present Value Techniques Accountingcoach

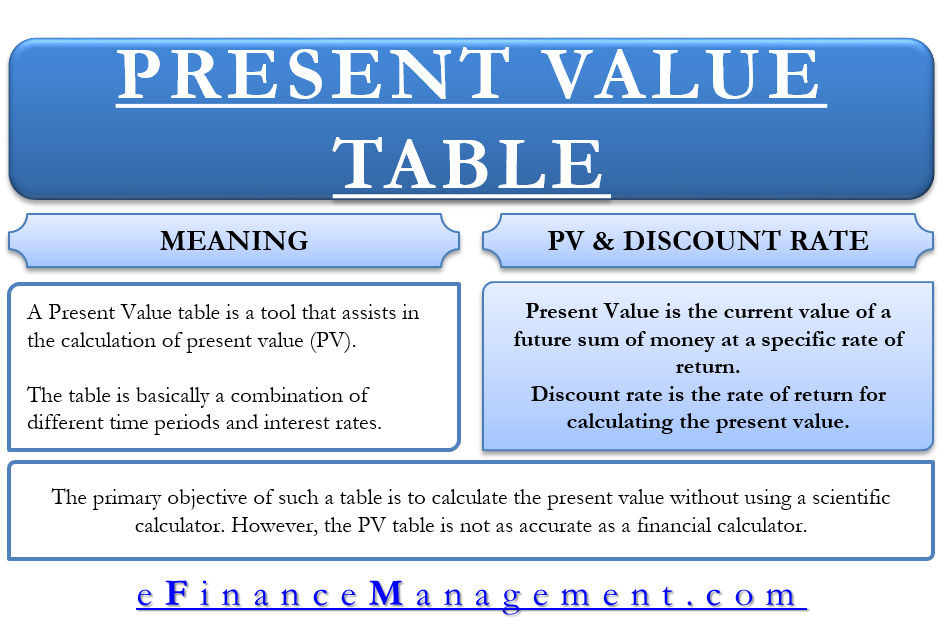

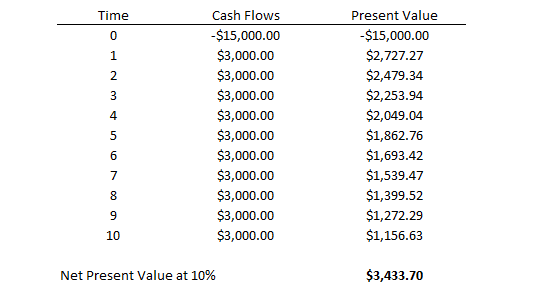

Net present value is defined as the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

. In exchange for a promissory note for 1000 that will come due on December 31 2024. Given the choice between receiving 1000 today and receiving 1000 a year from now most people would take the cash now because the value of money. Here i is the discount rate and n is the period.

Figure 89 Present Value of 1 Received at the End of n Periods. N number of periods until payment or receipt. Present Value Tables Figure 171 Present Value of 1.

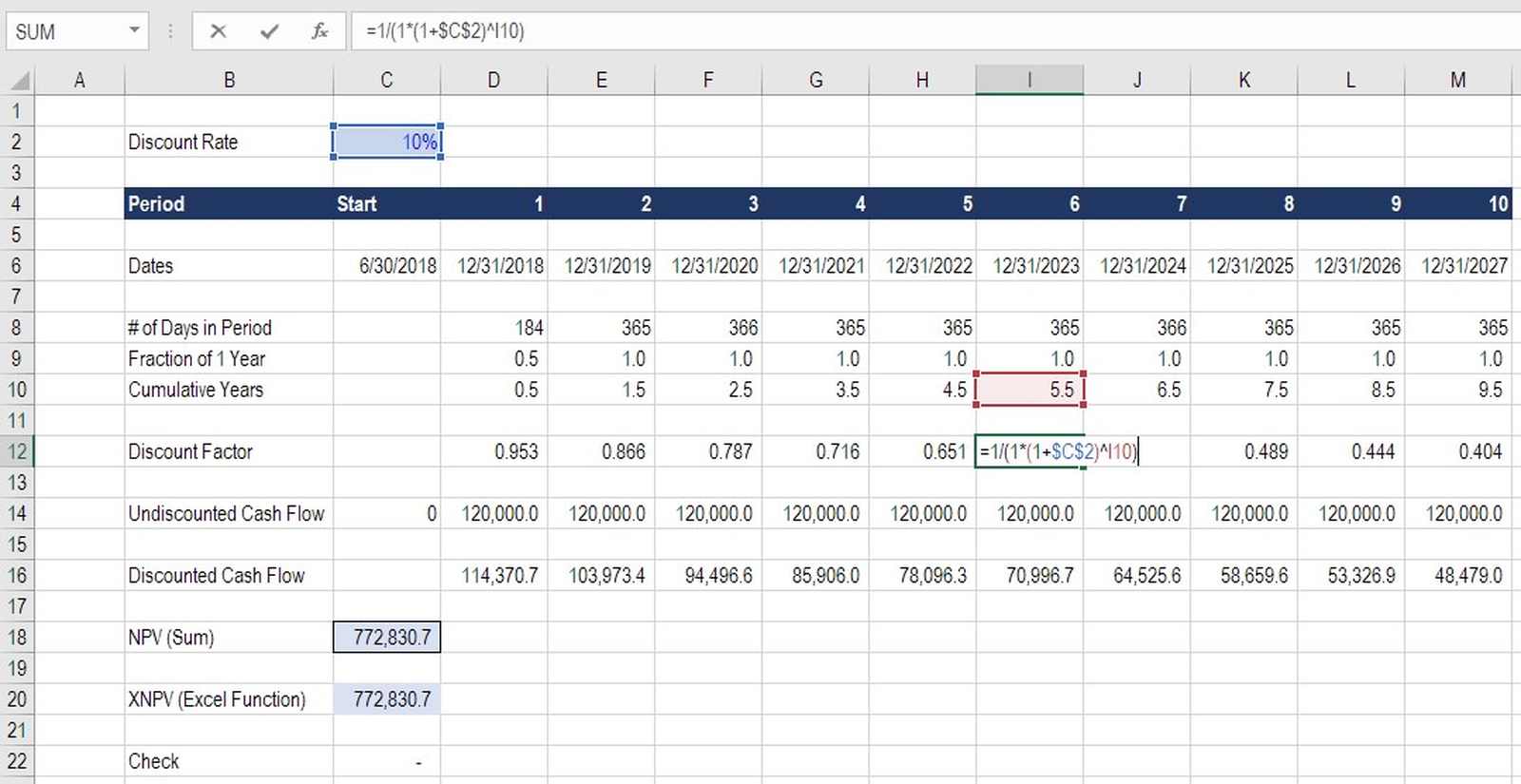

PV FV x 1 1 in PV tables are used to provide a solution for the part of the present value formula shown in red this is sometimes referred to as the present value factor. The note does not specify any interest and there is no market for the note. Use Excel to calculate the net present value of this investment in a format similar to the one in the Computer Application box in the chapter.

A present value of 1 table states the present value discount rates that are used for various combinations of interest rates and time periods. Many also call it a present value factor. Present value of 1 table is used to find the present value of a single cash flow payment or receipt that is expected to occur in future.

X 0 Cash outflow in time 0 ie. R Discount rate. The formula for Net Present Value is.

N P V t 1 n R t 1 i t where. Yes the equipment should be purchased because the net present value is positive. A point to note is that the PV table represents the part of the PV formula in bold above 1 1 in.

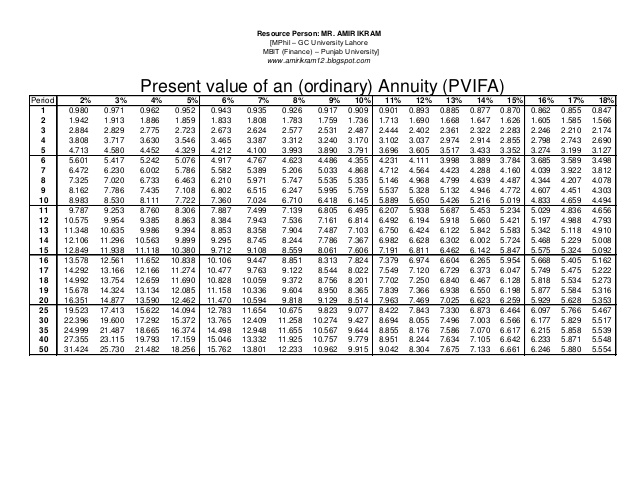

When you multiply this factor by one of the payments you arrive at the present value of the stream of payments. Value for calculating the present value is PV FV 1 1 in. NPV analysis is used to help determine how much an investment project or any series of cash flows is worth.

Present value of 1 that is where r interest rate. Performs a service for MedHealth Inc. Net Present Value Calculation Using Excel.

Describe the net present value method. If you dont have access to an electronic financial calculator or software an easy way to calculate present value amounts is to use present value tables. Figure 810 Present Value of a 1 Annuity Received at the End of Each Period for n Periods.

An investment costing 200000 today will result in cash savings of 85000 per year for 3 years. The net present value NPV A method used to evaluate long-term investments. The annuity table contains a factor specific to the number of payments over which you expect to receive a series of equal payments and at a certain discount rate.

The Indicated Value in Use in our analysis varies from 282 B to 186 B. The interest rate selected in the table can be based on the current amount the investor is obtaining. N P V.

1 r n Periods Interest rates r n. 34 Reporting a Balance Sheet and a Statement of Cash Flows. R t Net cash inflow-outflows during a single period t i Discount rate or return that could be earned in.

Compute net present value NPV of this investment project. Net Present Value NPV Formula. Table of Present Value Annuity Factor Number of periods 1 2 3 4 5 6 7 8 9 10 1 09901 09804 09709 09615 09524 09434 09346 09259 09174 09091.

PV FV x Present value factor PV Tables Example. Simple and compound interest Present value of a single payment in future Present value of an annuity Net present value method. Z 2 Cash flow in time 2.

Lets use the Present Value PV calculation to record an accounting transaction. Value from present value of an annuity of 1 in arrears table. 33 Increasing the Net Assets of a Company.

The Formula for NPV. Assume that Project 1 can be sold for 15000 at the end of the sixth year. Over time the value of money changes.

From accounting lessons to accounting services we help you meet your needs. Method of evaluating investments adds the present value of all cash inflows and subtracts the present value of all cash outflows. More from Capital budgeting techniques explanations.

Z 1 Cash flow in time 1. Net present value NPV PV cash flow 1 PV cash flow 2 NPV -5000 525920 NPV 25920 The net present value formula results in a positive number meaning that the return from the project must actually be greater than the 10 required by the business and therefore the project is worth accepting. The purchase price initial investment Why is Net Present Value NPV Analysis Used.

Project 1 Project Cost 160000 Cost 150000 Minimum desired rate of return. You can view a present value of an ordinary annuity table by clicking PVOA Table. The companys required rate of return is 11 percent.

A discount rate selected from this table is then multiplied by a cash sum to be received at a future date to arrive at its present value. It is essential to investigate further our assumptions for the discount factor and growth rate. It is calculated by adding the present value of all cash inflows and subtracting the present value of all cash outflows.

It is used in capital budgeting to determine the profitability of a potential investment or project. A positive net present value is a good thing and denotes a project that will exceed the. Business Accounting QA Library Using the table in Exercise 10 calculate the net present value for each project shown below at the end of six years and determine which would be the better decision for Mikes Camping Supply.

Should the equipment be purchased according to NPV analysis. PV FV 1 i n This can be re written as. On December 31 2021 Instafix Co.

1 Computation of net present value. 31 rows An annuity table represents a method for determining the present value of an annuity. Managerial accountants understand that net present value NPV techniques use time value of money tools to estimate the current value of a series of future cash flows.

If theres one cash flow from a project that will be paid one year from now then the calculation for the NPV is as follows. 13 Using Financial Accounting for Wise Decision Making.

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Appendix Present Value Tables Financial Accounting

How To Use Pvif Or Present Value Interest Factor Table Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv Definition

Present Value Table Meaning Important How To Use It

Net Present Value The Motley Fool

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv Definition

Advantages And Disadvantages Of Npv Net Present Value Examples

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Payback And Present Value Techniques Accountingcoach

Payback And Present Value Techniques Accountingcoach

Present Value Tables Double Entry Bookkeeping

Payback And Present Value Techniques Accountingcoach

Solved Table B 1 Present Value Of 1 Rate Perlods 1 2 3 4 Chegg Com

Discount Factor Complete Guide To Using Discount Factors In Model

What Is A Present Value Table Definition Meaning Example

Present Value Of 1 Annuity Table Online Accounting

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Comments

Post a Comment